Table of Contents

*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

From stories and tales as old as time, the conquest of gold and treasure have always been items of desire. For centuries, metals such as gold, silver, and platinum have been the guiding force of rising economies and kingdoms. Even today, no one can deny the powerful economic impact of these metals. But just how do these metals bend and twist with the tides of the economy? Can we, as individuals, see the pattern and economic footprint these metals leave behind?

What Are Precious Metals?

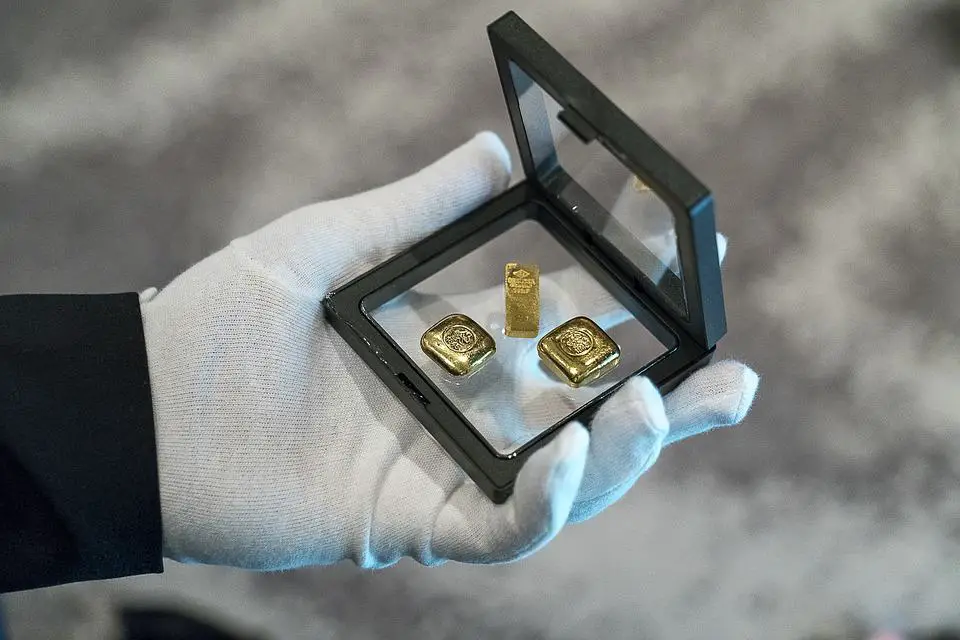

Precious metals are naturally occurring metals that hold a high economic value. In the past, these precious metals gained their economic value as currency or used through industrial commodities. Now a practice of the past, these precious metals used to find their value from being minted onto coins. In current times, we have upgraded to a paper form of currency which is supported by a larger government entity. These entities back the paper with reserves of precious metal: gold.

Types of Metals

The most widely known precious metals are gold, silver, and platinum. Other metals that hold high economic value exist but are less known: Rhodium, Palladium, Osmium, Iridium, and so forth. Each metal has its own set of uses ranging from investment, industrial material, or as a currency. More so, each metal has its own relationship with the economy: the value of some metals go up as the economy sinks, while the value of other metals decreases as does the economy.

Ever-changing Value

The value of these precious metals is constantly changing. When new metals are found with similar properties to preexisting metals, the value can diminish. If the global market produces an invention or industrial commodity that requires an abundance of certain precious metals, the value can increase. There is a wide pool of data on the economic impact and past fluxes in the price of these precious metals, but it’s important to remember that times are constantly changing. Being aware of the world’s movement and change will only help to ensure the safety of your investments.

The Benefits of Investing in Precious Metals

Why invest in precious metals? With so many investment opportunities and possibilities, it’s important to understand the benefits. Each metal has its own benefits for investment, but share commonalities amongst them.

Access to Information

Unlike newer investment in tech companies and start-ups, one appeal of investing in precious metals in the vast amount of information available. There are entire websites, peer-reviewed articles, and a plethora of other bodies of information that can aid in your decision making. The best investors in the world didn’t get there just from luck. Being well-informed and knowing the relationship between your investment and the economy it reacts with will put you ahead of the competition.

Diversity

The term, “precious metals” encompasses a wide range of investments. Think of each precious metal as an individual item with its own strength and economic impact. One metal may reap the benefits of an economic crisis. Another metal will profit during times of economic prosperity. Other metals are tied more closely to industrial manufacturing.

Precious metals can aid in creating a diverse portfolio. Balancing the weaknesses and strengths of each precious metals and its economic impact will prepare you for most scenarios. There isn’t a simple answer to how much of each metal you should hold for an ideal portfolio. The economy and current events are always changing. It takes a constant analysis of the world around you and to translate that into the economic impact that the precious metals hold.

Economy

Gold and the production of other precious metals is a global business. The World Gold Council commissioned the consulting firm PwC to figure out gold’s contribution to the global economy. PwC found that gold alone contributed to more than $210 billion in 2012. The production of gold generated over $78 billion and employed roughly 529,000 people in the year 2012 (www.gold.org).

In developing countries, gold mining is a significant export. This means there is a constant flow of raw material entering the global market. This raw material gets refined, redistributed, and consumed by first world nations. A report done by www.gold.org goes on to explain that the economic impact and funds generated by gold would be significantly larger if it accounted for the employment in artisanal production and indirect employment of gold mining.

The Economic Impact of Gold, Silver, & Platinum

Investments are tied to the wellbeing of an economy. A failing economy means a failed investment. With precious metals, the opposite can be the case. Economic dips and recessions increase the price of some precious metals. The reason for this lies in its tangible value. Even if the economy of one country fails and the paper currency collapses, the inherent value the world places on gold and other such precious metals make these metals more immune to these drastic economic fluctuations.

This isn’t to say that your investments in precious metals are invulnerable. Each metal has its own usefulness and perceived wealth that can change as the economy does. For example, most of these rare metals have some industrial use and, due to economic stress, the manufacturing sectors could buy less of these materials.

Gold

Gold reacts to the economy most closely to the scenario we’ve painted above. As the economy tanks, the price of gold inversely increases. People who worry about the direction the economy is going will look to invest in gold: driving its price up.

But, why is gold so safe as compared to other precious metals? Historically, gold was used to back up the currency of governments around the world. In times of great economic downturns, governments carry a reserve of precious metals that hold a tangible value to the international market.

Since large global entities own such vast reserves of gold, there is one thing to watch out for: if one of these large entities were to sell their gold, the excess supply can reduce the price of gold. With more supply and an equal demand for gold, this would put gold owners in a pinch. This is not a common practice but is worth mentioning when investing in a globally affected commodity.

Silver

Silver reacts to the economy similarly to gold, but on a much smaller scale. With a price per ounce that is significantly less than that of its shiny partner, what makes silver great is its low-cost entry and relatively safe investment.

From a short-term, day-to-day analysis, silver’s price is volatile: being almost twice as volatile as gold. That being stated, silver is a great investment to have in a diversified portfolio due to keeping the same effect as gold in a struggling economy (but to a lesser extent). Much like gold, silver also gains its value from industrial commodities.

Silver is often stated to be the safe haven of investment. More so than gold, this metal can provide a safety net in an investment portfolio, having little fluctuations in the long term if left untouched. Due to its low cost per ounce, most people do not invest in silver who are looking to flip the metal for high profits.

Platinum

Unlike the other two metals listed above, platinum is different. Metals similar to platinum (such as palladium) retain most of their value through industrial demand. During times of economic success, these precious metals can see great returns. When the manufacturing sector of an economy ramps up, the demand for these metals will also increase. Inversely, as the economy is stressed and manufacturing goes down, the price of these metals plummet.

White precious metals, such as platinum, are increasing in importance. Academic literature on the financial economics of platinum can be found on silverseek.com. From the summary they provide, they identify the rising confidence countries have in platinum, and as an effect, it is increasing in value. This confidence is increased when data used from their studies show the ability of these white precious metals to hedge inflation.

Conclusion

We live in the information era with investments in precious metals dating back decades. There are many statistics and databases you can use to your advantage before investing in these precious metals. Being able to understand and use this information is a luxury not all investments share. Knowing the economic impact of gold, silver, and platinum allows you to create a strong, well-informed, and diverse portfolio. This is a benefit you won’t find with every field of investment.

Every investment comes with risks. These risks can include the unpredictable nature of the economy, the constant short-term depreciation in the assets we fear could turn to long-term loses.

Yet, precious metals hold a stability almost no other investment can boast: with global entities using gold as a financial reserve, developing nations constantly producing new precious metals, and an array of first world nations ready to manufacture gold products. Do your research and see for yourself why so many eyes are caught by these precious metals’ shine.

Will you strike gold?