Table of Contents

Iridium is one of 31 transitional metals and one of a handful of precious metals along with gold, silver, platinum and palladium. With a limited mining rate and location, iridium is a rare precious metal with a high investment point and a solid regular increase in value.

*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

What is iridium and what is is used for? In this article we will cover the metal, how it is used as well as covering investment options, strategies and the pros and cons of investing in iridium.

To see some options for iridium that you can easily buy just click here.

What is Iridium?

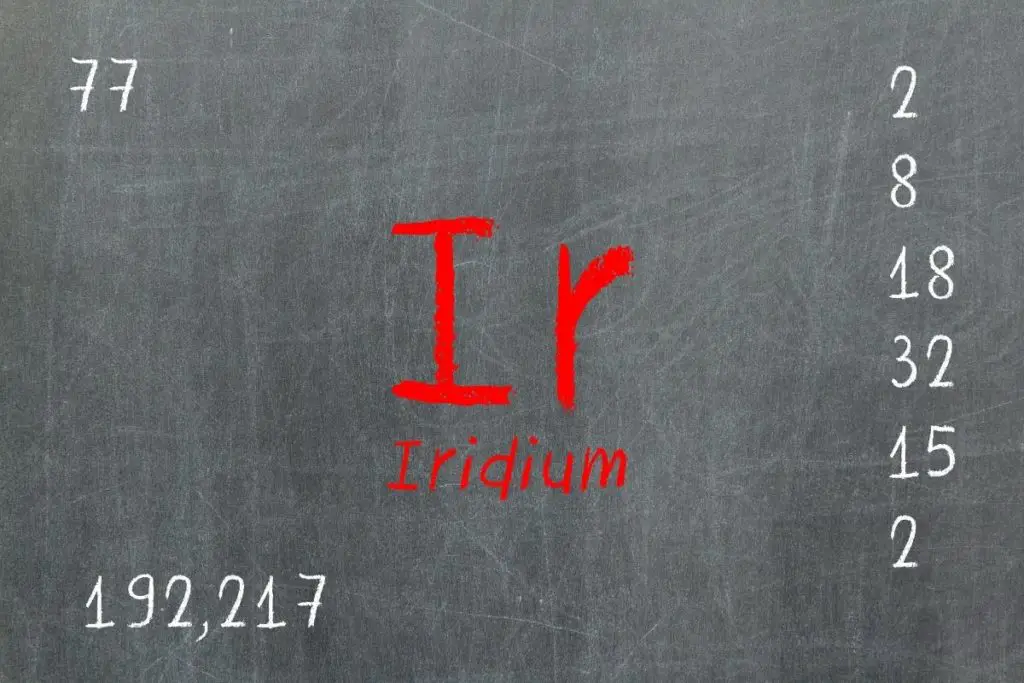

Iridium metal is a precious metal in the transitional metal section of the periodic chart. The element, with an atomic weight of 77, is the second densest element (second only to osmium). Iridium is also the most non-corrosive metal, especially at very high temperatures.

Iridium was found by Smithson Tennant in 1803 and named after Isis, the Greek goddess of rainbows. Tennant named it so because of iridium’s colorful presentation of its salts. As a solid, it presents with a silver-white color much like platinum.

The metal has a very high melting point (4403 Kelvin) and also becomes a superconductor at very low temperatures ( < 0.14K). It is very difficult to mold and work with, powder metallurgy is often employed to form the metal.

Iridium in the Earth’s crust is also very rare. Commonly mined in Russia and China, along with other transitional precious metals, it is believed that there is much more iridium element deep in the Earth’s core due to it’s ability to bind with iron.

Iridium is also found in high concentrations in space. Comets and other celestial beings have been found to have concentrated amounts of the metal. Made made structures also contain the metal that are in space. Investors are hoping we can find more pockets here on Earth, or bring some of the concentrations found in space back home.

What is the Value of Iridium?

Several factors determine the value of a metal, including demand. Gold and silver are the most common metals that have a high demand. The demand for iridium is largely industrial based. Other factors that determine value are rarity and uses.

Rarity

Iridium in the Earth’s crust is very rare. Iridium reports in at only 0.001 parts per million. To put this in perspective, platinum is ten times more abundant. Gold is forty times more abundant and precious metals silver and mercury are over 80 times more abundant.

The instance of iridium in meteors and meteorites, by contrast, is at a rate of an average of 0.5 parts per million. One particular meteorite, the Willamette Meteorite, has an iridium level of 4.7 parts per million.

Since iridium has such a rare occurrence on Earth, the value rises substantially. Unlike other types of commodities, there is a finite amount of iridium and we can’t just print more whenever we like.

Uses

As a metal, iridium has several practical uses. It is commonly mixed with platinum to increase the durability and strength. On its own, iridium has more practical uses in industrial settings.

In particular, heavy machinery will use the strength of the metal in construction of components and machines that require high heat strength. Other uses come in the form of automotive uses.

The automotive industry uses iridium in many applications, however, the most common are in spark plugs and catalytic converters. With growing emission controls, the need for iridium is growing. Iridium spark plugs replace lead and titanium for their ability to maintain form and durability even over extreme high heat.

These uses alone raise the investment value and return on iridium. However there is another factor that adds even more to the value: NASA.

The uses of iridium in satellites has become common and increases every quarter. The superior resistance to malleability and ability to withstand extreme temperatures makes iridium invaluable to space exploration.

One side effect of the use in satellites is the appearance of the metal as a shiny silver-white reflection. Often times these result in flashes from space. The flash, which is known as iridium flare, is when the iridium reflects sunlight and it appears in the night sky as a bright flash, or flare, seemingly from nowhere.

The Value of Iridium

Iridium has a five year average of around 900 USD. End of the year (2017) iridium stood between 950 and 970 USD per ounce. As a comparison, gold ended 2017 with an average of 1270 USD and silver averaged 17 USD.

Should You Invest in Iridium?

Precious metals are commonly invested in with several different methods. Unlike the big three: gold, silver and platinum, iridium doesn’t commonly get traded as an EFT.

It is possible, however it is uncommon due to the high cost per ounce and the industrial requirements using up most of the metal. Other options are used though:

- Common Stocks and Mutual Funds. Iridium miners in the United States, Canada and Russia are traded and tend to have higher returns in the long term due to their constant 5-year averages.

- Futures and Options. Liquidity of the metal offers traders the highest risk/reward of any other option.

- Bullion. Coins and bars are uncommon with iridium but not unheard of. The main issue traders have is with the storage and control of the tangible items.

- Certificates. Certificates are common in precious metals, however, Doomsdayers will balk at certificates since in the event of a devastating catastrophe, no one will take or trade paper certificates.

Where to Invest

Most investments will come from the mining companies or companies that use or refine iridium. These companies include:

- Norilsk Nickel (OTC: NILSY)

- Anglo American (LON:AAL, PINK:AAUKY)

- Lonmin Plc (LON:LMI, PINK:LNMIY)

- Ruiyuan Group Limited

- American Elements

- Johnson Matthey

- Zafirro

You can also buy iridium metal in bars, coins, metal objects, etc. There are many websites that sell or allow resale of iridium items. You can also find researchable databases to find other options.

Pros of Investing in Iridium

Investing in iridium has its advantages, here are some of the most common pros:

- Prices rarely fluctuate since it is a rare material. Prices will go up when more is mined.

- Increased usages outside of the industrial complex mean a greater need for iridium.

- Iridium has intrinsic value.

- Iridium carries zero credit risk and itself cannot be inflated.

Adding iridium to your portfolio is considered a safe investment. Even having a few included in your portfolio reduces risk and vitality overall. This doesn’t mean investing in iridium or other precious metals isn’t without any risk at all.

Cons of Investing in Iridium

As with any investment there is always a risk. Nothing is certain and nothing can be expected. Here are some of the more common disadvantages in precious metal investing:

- Physical investing is difficult. Bars, coins and other items are not readily available.

- Iridium prices tend to stay at a premium so initial investing is costly.

- Iridium is rare because of it’s difficulty to separate from other materials. Aluminum was once a precious metal for the same reason and is now a common metal.

- If you have physical investments there is a threat of theft or loss.

- Value gains are taxed as collectibles.

- Iridium isn’t recognized as legal tender and exchanging can be difficult.

For those that prefer physical investing, iridium is a viable option as long as you have a secure space for storage. Certificate investments are less risky but experience quicker losses when prices drop.

In Conclusion

Iridium is used in mostly industrial areas of manufacture. From satellites and mobile phones to spark plugs and other automotive parts. You will also find iridium in machinery that needs added strength or operates in higher temperatures.

Unlike gold, silver and platinum, iridium is not popular in jewelry or heirloom style investments. It is however combined with other precious metals to add strength and durability. Iridium finds new uses every day and science has used the salts for just about everything in industrial design.

As an element, iridium is rare in the Earth’s crust making it more valuable. It is only reported at 0.001 parts per million which is over eighty times less than silver. However, there is an abundance of iridium in space. Meteors and meteorites have shown to contain an average of 5.0 parts per million of the precious metal. As of this time there is no known method of mining iridium in space, nor a need to.

As an investment, iridium holds the same strengths and weaknesses as most other precious metals. While gold, silver and titanium have more uses, iridium holds a value and low risk that equals or beats these other metals.

If investment of iridium is right for you is a personal choice. How you invest, either physical, certificate or stocks in mining companies, is up to you. Without regular check ins though, even precious metals can ruin a portfolio and your finances.