Table of Contents

Platinum coins are increasingly becoming a popular option for investment. Official platinum coin issuances are now commonplace, and experts assert that these collectibles will return investment handsomely. The price of platinum rises relatively slowly, however, usually around 80% over a five-year period, so a patient game is required to allow for the “long-term character” of platinum to evolve.

*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

Is platinum a better investment than gold? And what type of platinum is the recommended purchase, bars or coins? Continue reading below, and we’ll discuss these questions and more, including what types of platinum coins are available and what value they currently possess.

Platinum or Gold?

While it has not always been true, over the course of history, platinum has had a tendency to be valued higher than gold, and the general consensus today is that platinum is the most precious and valuable of metals. If you’ve visited a jeweler lately, you will know that platinum pieces are almost always priced higher than similar gold editions. And of course, there is no more elite an achievement in the music industry than to earn the title of a “platinum” record, one that has reached the 1 million units sold plateau.

But, if a certain abstract hierarchy among the precious metals places platinum at the top, there are very real, material reasons for this. Platinum is considered by experts to be nearly twenty times scarcer than gold in terms of annual production from mines. This data alone accounts for the fact that platinum sells consistently higher above its benchmark price than does gold.

Bars or Coins?

Why should you choose to include platinum coins in your portfolio over bars? Well, first, you might consider the significant advantages coins possess in a cultural and social appeal that are not existent in bars. Furthermore, coins consistently register a higher level in terms of collectability, as they possess real numismatic value. They are crafted with utmost skill and imbued with a beauty unmatched in the more utilitarian aesthetic found in bars.

Coin popularity results in more liquidity than bars due to the ease with which they are traded in the marketplace. Because bullion coins garner their popularity from the official issue and denomination face value, they will certainly have greater appeal should unexpected crises occur in the financial world.

What Are Platinum Coins, Exactly?

Platinum coins are a type of currency, initially used by Spain for dissemination among their colonies in the Americas in the 1700s. Platinum coins were also in frequent use by the Russian Empire in the 1800s. Because platinum bears a resemblance to less expensive metals, and because it is not as malleable as gold or silver (and therefore more difficult to manipulate), it became a less popular choice for the minting of official coins.

Over the last forty years or so, however, there have been many commemorative coins minted around the world that have proved very popular with collectors. In addition to the coins we will look at below (the Austria Vienna Platinum Philharmonic Coins, the American Platinum Eagle Coins, the Canadian Platinum Maple Leaf Coins, Australian Koala Platinum Coins and the Isle of Man Platinum Noble Coins), both Russia and China have issued their version of official platinum coins.

5 Platinum Coins for Investors

Deciding which platinum coins to include in an investment or retirement savings portfolio can prove challenging. However, there are five popular options in the purchasing of this rare precious metal that may be right for you. The five platinum coins discussed below are all IRS approved for inclusion in an Individual Retirement Account (IRA) and as such, meet specific purity requirements laid out by the Internal Revenue Service.

Austria Vienna Platinum Philharmonic Coins

The Austrian Vienna Philharmonics are the leading bullion coin in Europe. In 2006, the platinum editions of these much-loved classics were issued. Resembling their cousins, the Austrian Gold Philharmonics and the Austrian Silver Philharmonics, the platinum versions show an image of the Vienna Golden Hall Great Pipe Organ on its obverse side and a selection of the various instruments played by the acclaimed orchestra on the reverse.

Produced by the universally acclaimed Austrian Mint in Vienna, the coins exhibit the purity, artistry, and quality for which the mint has become well known for during its long history. The Austrian Mint first struck coins eight hundred years ago with ransom silver paid to the Austrian Archduke by King Richard of England, the Lionheart. The current coins are forged bearing a 100 euro face value, which places them over double the value of their American counterparts. In fact, the face value of the Austria Vienna Platinum Philharmonic coin is currently the highest in the world.

American Platinum Eagle Coins

You will only find a single, solitary platinum coin issuance from the United States government, and that is the American Platinum Eagle first issued in 1997. Not only are they instantly recognizable, but they are also the only American coin to change its reverse side design each year. When a government issues an official platinum coin, it is essentially guaranteeing the veracity of its content, weight and purity level, so the fact that the US puts its stamp on only one platinum coin makes the Platinum Eagle extremely unique.

It was only after the director of U.S. Mint, Philip Diehl, teamed up with the Director of the Platinum Guild International, Jacques Luben, and the President of the American Numismatic Association, David Ganz, to lobby for a platinum version of the beloved American Eagle coins that Congress finally authorized a minting of the Platinum Eagle. Similar to the gold and silver iterations of the American Eagle coin, the platinum version is made for collectors, polished to a shine and engraved with a skill unsurpassed in American coinage. This one-ounce coin has a face value of 100 USD.

Canadian Platinum Maple Leaf Coins

In 1979, Canada dipped their toes into the precious metal game with the super popular Gold Maple Leaf coin. A little under ten years later, they entered into the world of platinum coinage with a one ounce, 50 CDN coin. Unlike its gold and silver brethren, the platinum coin has not been released every year since, and as such, has become a much rarer and highly valued coin.

Until 1990, the two versions of the Platinum Maple Leaf coin have displayed a younger representation of Queen Elizabeth. However, in honor of her 64th birthday, the Canadian platinum coins from 1990 to 2001 would display an older, vintage bust of the venerated sovereign. After 2001, the Royal Canadian Mint decided to end their yearly production of the coins and instead strike a rare holographic collection in 2002. This marked the last platinum coin struck in Canada until 2009 when they forged a limited version featuring an image of the Queen at the age of 79. Canadian-issued platinum coins have all been struck with a face value of 50 CDN.

Australian Koala Platinum Coins

In1988, the Perth Mint of Australia first minted the Australian Platinum Koala and have subsequently issued the coin each year. Upon its initial striking, it became such a massive success that it influenced the governments of Canada and the USA to mint their platinum versions shortly thereafter.

In 1991 Australia began minting two ounce, ten ounce, and kilogram platinum coins available for purchase from the Perth Mint. The platinum issues of these coins have always been kept to limited issuances, ensuring their value going forward. Many consider these gorgeous coins as the most skillfully crafted in the world.

Isle of Man Platinum Noble Coins

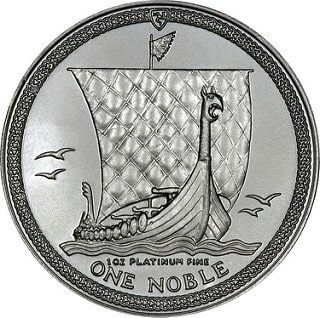

How is it that our fifth recommendation of a platinum coin investment comes from a small island off the coast of England, the Isle of Man? For many centuries this island was a Viking kingdom, and today, it still technically maintains a modicum of independence. Their history is renowned for having always produced interesting coins, and they are now known for issuing platinum, gold and silver coins on a consistent basis. The Platinum Noble, a coin easily purchased on today’s market, is their first strike in the world of platinum coinage.

These coins are made unique by the fact they are not actually minted by the Royal Mint in the UK or a national mint on the Isle of Man. Pobjoy Mint of Great Britain stuck these coins when they were commissioned by the Isle of Man in 1983. Even though these unique coins are not struck by any national mint, the IRS will still accept them for premium IRA investment as they are produced to specific requirements of the UK-based Royal Mint.

Conclusion

For those still cautious about investing in platinum coins, there are many reasons to consider these unique items as an investment option. For one thing, bullion coins enjoy a consistently higher level of collectability as opposed to platinum bars. Another consideration is that platinum coins will provide greater liquidity on the open market than bars, and will, of course, prove to be more popular. A third thing to consider is that due to the fact platinum coins are struck as legal tender and display their face value, they will possess a certain appeal should another global financial crisis ever occur.